Life Policies Cost Above RM200/Month—This M’sian Startup Sells Them For As Low As RM9.85

The insurance penetration rate for Malaysians is only a little above half, which experts think is “grossly underinsured“. Among those, only 15% of bumiputras are covered at all.

Even when Malaysians are covered by insurance, they’re not covered enough.

There have been many efforts over the years to rectify this issue.

But with that being said, many Malaysians don’t think that this is an issue at all. In fact, many of us have a lot of misconceptions and misunderstandings when it comes to insurance and its agents.

There perhaps needs to be a different way of selling insurance to Malaysians. This startup thinks they might have found one method—PolicyStreet works by curating insurance products.

“Our vision is to get everyone “adequately” protected without worrying about rigid policies and confusing fine print at all stages of their lives for things that’s most important to them.”

– Yen Ming, founder of PolicyStreet

Yen Ming got the idea for PolicyStreet after he injured himself falling out of a tree. He fractured two of his vertebrae, T11 and T12.

It was a painful process—and all of the paperwork surrounding it was tedious—but Yen Ming was glad to have been cared for in a great facility.

It got him to thinking.

“Insurance is always seen as a cost and not a need to have. And when any unforeseen circumstances happen to us or our loved ones, it is often too late. And I have seen time and time again in my life that unfortunate things happen when we least expect it.”

So, this is how PolicyStreet works.

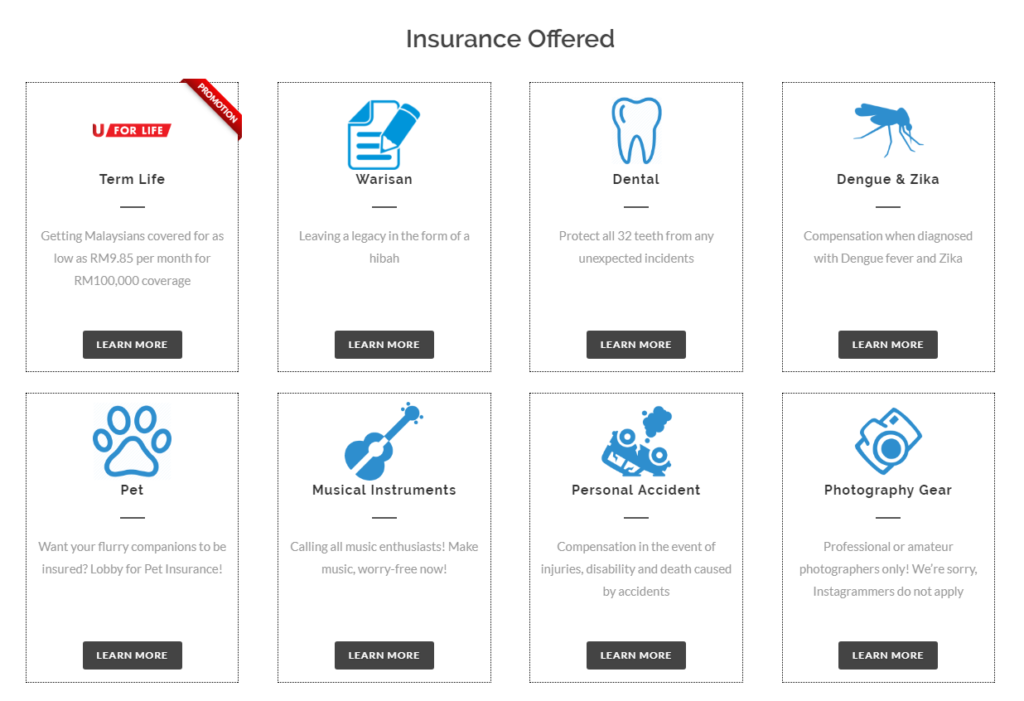

- They hand-pick insurance products relevant to their target customers—millennials, usually.

- Insurance agents don’t generally sell the products that PolicyStreet does, because the price points are too low for them to earn a decent commission.

- They let users sign up online, instead of having to sign a physical form.

- They focus on approaching groups of like-minded individuals by trying to understand their needs, and then curating specific insurance policies to suit their lifestyles.

So without fighting for space with insurance agents—and in fact they seem to have a partnership with some of them—PolicyStreet can offer life protection for as low as RM9.85 a month.

In comparison, an agent would usually sell a comprehensive investment-linked life protection for about RM200 to RM300 per month.

We noticed that PolicyStreet calls their offerings insurance ‘products’ instead of insurance ‘policies’ or ‘packages’.

This bit of semantics does tell us a lot about how they manage to sell for cheaper—they’re selling the individual ‘product’ instead of the packaged set.

“We aim to democratise the traditional insurance industry by making insurance sexy, fun and relevant to the millennials of today. We want to change the perception of insurance by providing the right education and awareness.”

Insurance is a lucrative industry; total premiums and contributions amounted to RM61.3 billion in 2016, according to Bank Negara.

By tapping into a usually unsellable niche, PolicyStreet has been profitable since day one.

They win by figuring out the needs of groups with specific interests.

“In our aim to not compete with these providers, we have taken the unorthodox approach of going after groups with like-minded individuals where we continuously engage to better understand their needs and demands,” said Yen Ming.

In fact, it was this group focus, or as the team calls it the B2G focus, that won them a seat to pitch for Seedstars next year in April.

“To us they are individuals but individuals that belong to a cluster or group that has common interest. And we believe this is should be the way forward as we see the mushrooming of groups in chat engines and social media.”

“And through these groups, we are also able to curate new products through crowdsourcing of interest based on market demands.”

Of course, insurtech isn’t the easiest space to enter.

The insurtech scene in Malaysia is dominated by big players that have done well for themselves following a certain set of rules.

And while the team thinks that they’re carving out their own path in the insurance scene, “Some have seen us as taking their business away from them. It has been difficult to explain the different sets of customers that we are targeting and the needs that we are addressing.”

They’re also opening up insurance options for Malaysians who aren’t aware of, or don’t have access to more one-of-a-kind insurance products more readily available overseas.

Currently, PolicyStreet has “protected more than 600 lives in Malaysia” with over RM60 million in pure protection in terms of the sum assured.

By empowering the normal layman who don’t understand insurance, and cherry-picking cheaper insurance options that can drive costs down, the team hopes to encourage the approximately 46% of uninsured Malaysians to get at least basic protection.

To continue on their insurance path, the team continues to crowdsource their information not just from interest groups, but the public at large.

Eventually, they aim to be able to curate micro-products on demand, based on a need, personalised through blockchain and big data analytics.

*The original news: PolicyStreet: Startup Curating Affordable Insurance For Malaysians (vulcanpost.com)